The private lending market has evolved significantly over the last 20 years. Now one of the fastest growing and most coveted asset classes for investors, private debt is increasingly playing a pivotal role in providing capital to lower and middle market businesses. Throughout this article we will examine the reasons behind the emergence of private debt, how it has evolved over the last decade, the risks around its staying power, and where private debt investors continue to find opportunity.

The Consolidation

The 1990s and early 2000s were witness to a massive reworking of the banking sector in the United States. Consolidation, fueled by large names like Bank of America, Wells Fargo, Citigroup, and JP Morgan, resulted in national banking platforms as compared to the distributed landscape experienced for much of the 20th century. According to the FDIC, in 1990 there were 12,351 FDIC-insured commercial banks in the United States. By 2005, that number had decreased to 7,524. These larger national banking platforms resulted in a realignment of lending preferences away from loans to small and mid-sized businesses and towards larger corporate borrowers. Larger corporate borrowers presented the opportunity for banks to extend greater sums of financing while cross selling other related services. However, the reduced attention paid to small and medium sized borrowers was not indicative of lack of appetite or need for debt financing from the segment.

The Crisis

The financial crisis of 2008 catapulted the global economy into disarray and rewrote the playbook for debt investing for years to come. Commercial banks, once the stalwarts of lending activity, found themselves teetering on the edge of collapse. In the midst of the crisis, solvency issues and general anxiety around the depth of the crisis led to the traditional debt markets drying up. As the crisis spread, governments started to intervene, lowering key central bank rates and directly purchasing troubled assets associated with risky mortgage securitization activities. The consolidation of the 1990s and early 2000s intensified, with large national banking platforms snapping up their struggling competitors. As the dust settled, new regulations emerged which further disincentivized commercial banks from extending credit to small and medium sized borrowers. Larger balance sheets and stricter capital requirements meant that commercial banks were still focusing on larger corporate borrowers.

As the recovery began to materialize and the economy looked towards growth again, debt financing was sorely needed. In the United States, small and medium sized businesses are a fundamental component of broader economic health. The World Economic Forum estimates that “middle market” businesses, defined as companies with revenues from $10 million to $1 billion produce approximately 1/3rd of U.S. GDP. Further, Dun & Bradstreet estimates that middle market businesses employ roughly 28% of the private workforce.

The Evolution of the Private Lending Market

Private lending as an asset class began to emerge in the late 1980s early 1990s. At its start it was mostly comprised of special situations or mezzanine lending strategies. Due to their private nature, these funds were able to extend debt financing in atypical situations. For example, special situations groups had the flexibility to approach highly risky credits with unconventional structures. Mezzanine funds acted as a hybrid between traditional bank debt and equity financing, allowing businesses to max out leverage beyond what would be feasible from traditional commercial bank lenders and raise financing at a lower cost of capital than equity.

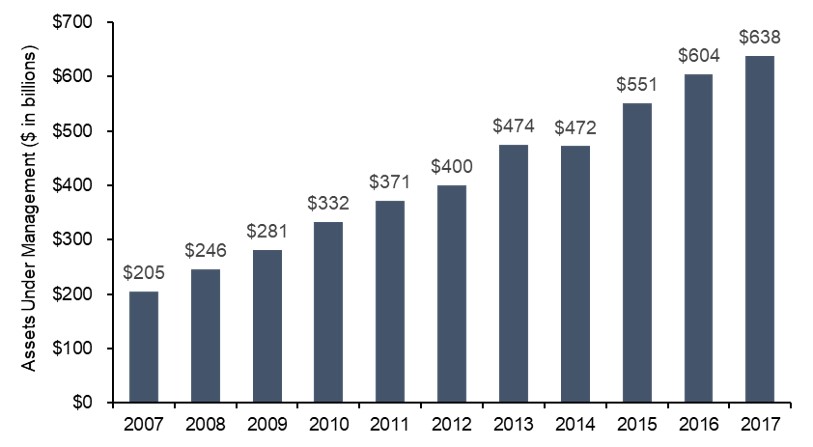

As traditional commercial banks consolidated and struggled with how to deal with the new post-crisis paradigm, capital began to flow more aggressively into private lending strategies. Institutional investors were attracted to the strategy due to its strong risk-adjusted return profile and promise of portfolio diversification. As illustrated in Figure 1, the result has been a large increase in private debt assets under management over the last 10 years, creating a robust standalone asset class.

Figure 1 – Private Debt Assets Under Management (2007 to 2017)

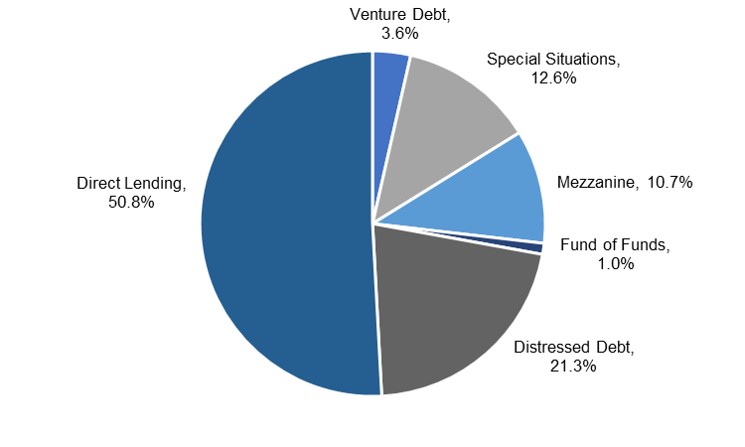

In addition to an increase in the amount of capital flowing into the private debt market over the last 10 years, fund types and strategies have become more nuanced and sophisticated. Direct lending has risen in prominence, becoming a cornerstone of the middle market lending market. Venture debt has become more entrenched, providing non-equity alternatives to earlier stage companies looking for financing. Fund of funds have even claimed a piece of the action, providing investors with a broadly diversified take on the overall private debt market. Figure 2 shows the breakdown by fund type of the approximately $107 billion of private debt fundraising in 2017.

Figure 2 – 2017 Private Debt Fundraising by Fund Type

The Future of Private Lending

At the start of 2018, investors continued to view private debt as an attractive area to invest going forward. A survey conducted by Preqin showed that more than 85% of investors had either a positive or neutral view on the private debt asset class. Further, 42% of investors indicated that they planned to increase their capital commitments to private debt funds over the next 12 months.

This enthusiasm around the private lending market has been borne out by fundraising activity through Q3 2018. For example, Q2 2018 was the third largest quarter for private debt fundraising ever, with 36 funds raising an aggregate of $42 billion. Q3 slowed slightly to $24 billion, roughly on par with the $20 billion raised in Q1. This all points to a future where private debt continues to play a large role in the financing needs of the middle market.

Despite the surge in private debt strategies, investors have expressed concerns about the go-forward performance of the asset class. Principal to these concerns is the rise in valuations and the increased difficulty in finding quality investment opportunities. This is not dissimilar to the concerns in private equity as an asset class. To put it another way, the market generally falls victim to recency bias and with asset prices near all-time highs and the longest economic expansion in US history, many market participants believe this trend will merely continue. This exuberance has resulted in larger amounts of debt-focused capital facing fewer quality opportunities. While this has been great for borrowers, it has resulted in tighter pricing, more relaxed covenants, and less overall protection for lenders.

To borrow a line of thought from Ray Dalio and his theories on debt cycles (found here), one could conclude that—due to a confluence of different factors—we are nearing the top of a “big debt cycle.” The U.S. Government, in conjunction with the Federal Reserve, utilized a multitude of inflationary tools to combat the effects of the global financial crisis (i.e. printing new money to purchase government bonds and other assets, while lowering key interest rates to near zero). The result of these actions was an increase in asset prices and the thawing of credit markets relative to their mid-crisis levels. This was instrumental in staving off a deeper and more prolonged economic catastrophe. However, once these actions began to improve the economic picture, offsetting deflationary measures, such as tax increases, decreases in spending, and debt reduction didn’t necessarily follow. This has resulted in an unbalanced situation.

While Dalio and others do not think that there is an impending crisis on the horizon, signs are beginning to point towards unsustainably high levels of debt and asset prices that are artificially inflated. It begs the question of whether or not the current levels of private debt activity can be sustained for the years to come or if we might expect a cooldown. For instance, if growth in business income and asset prices begin to stall or even decrease, we will be presented with an environment where existing loan-to-value ratios seem artificially high and debt service burdens are unsustainable.

Areas of Continued Excitement

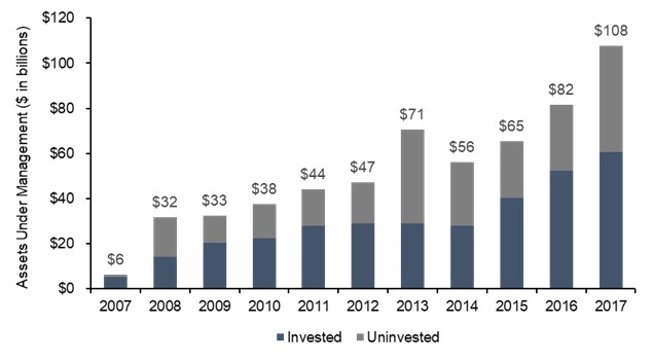

Direct lending as a strategy has seen one of the largest increases in assets under management since the global financial crisis. Figure 3 below illustrates the meteoric rise in both invested and uninvested assets under management for U.S. direct lending funds.

Figure 3 – Invested and Uninvested Assets Under Management for Direct Lending Strategies

Most of the rise in direct lending can be explained as a specific response to the reduction in lending from banks following the 2008 crisis. By definition, direct lending represents debt financing that is originated directly from business owners or private equity groups. This is in contrast to syndicated loans whereby an arranger, usually a bank, brings together a group of lenders for a fee. As banks moved up-market, direct lending became a key component to the debt financing ecosystem in the middle market. Figure 4 represents a partial view of some of the largest firms that employ direct lending strategies.

Figure 4 – Representative Sample of Large Direct Lending Organizations

In addition to the segment of direct lending, certain industry specific strategies have been gaining traction over the last few years. The business characteristics of later-stage technology companies position them as ideal candidates for debt financing. For example, later-stage software businesses typically exhibit high degrees of recurring revenue, strong growth rates, healthy gross and EBITDA margins, and comparatively high valuations. This results in a relatively less risky credit and a lower loan-to-value ratio than in other industry segments. Business owners in the technology industry have also woken up to the fact that debt financing can be an attractive alternative to traditional equity financing.

Further still, a surge in private equity buyouts of software companies has accelerated demand for debt financing focused on technology and software companies. Similar dynamics can be seen in the broader healthcare industry, another segment that has experienced elevated debt financing activity in recent years.

The Conclusion

The private debt markets have risen in both notoriety and economic importance over the last 20 years. They now represent a distinct, standalone asset class that is attracting ever increasing sums of investor capital due to the promise of attractive risk-adjusted returns and diversification. While more insulated to volatility in asset prices and inherently less risky than equity, there is a real possibility that broader macroeconomic changes and market crowding present a potentially turbulent future for private debt. If anything is clear, it is that private debt will continue to play a significant role in the future growth of the U.S. and global economy.

Discover unique insights from growth investors and leading executives.

Sign up for our weekly newsletter.